Black Swan Event Explained!

A Black Swan Event is a metaphor describing a rare and unpredictable occurrence that affects the economy on a high level. Such events have three characteristics:

Extremely rare and unpredictable.

Have severe consequences on the economy and populous.

A plausible explanation is deduced only after the impact.

WHY 'BLACK SWAN'?

The metaphor ‘Black Swan Event‘ is derived from the spotting of the black swans in Australia in the 17th century by the Europeans. Before it, Europeans’ identification of swans was limited to only one colour i.e. white.

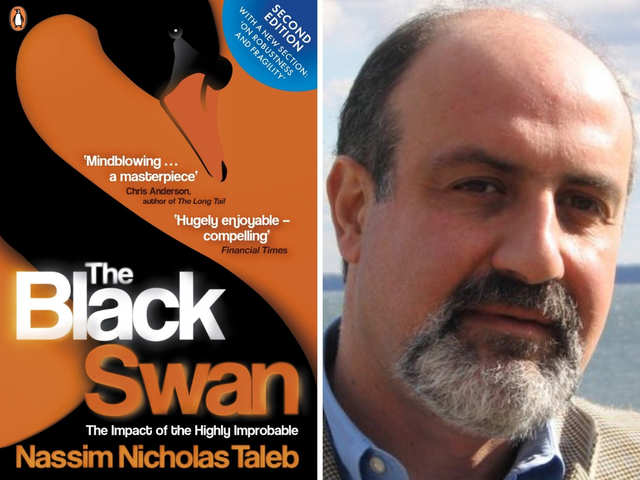

Afterwards, the Black Swan theory was introduced by Nassim Nicholas Taleb in 2001 and then published in his book “The Black Swan: The impact of the highly improbable” in 2007.

WHAT ARE POSITIVE BLACK SWAN EVENTS AND NEGATIVE BLACK SWAN EVENTS?

A positive Black Swan Event is where the downside of the event is capped while the upside is unlimited. Few areas Nassim Nicholas Taleb identified where a positive Black Swan Event can occur are publishing houses, cinemas and scientific research.

In movies, one only invests once and then exposes it to viewers over many platforms simultaneously. If the movie becomes a hit, it is a positive Black Swan Event, the same goes for a Book as Taleb describes:

“You have little to lose per book and, for completely unexpected reasons, and given book might take off. The downside is small and easily controlled.”

Even in scientific research, an unexpected breakthrough can benefit decades to come. Penicillin, one of many medical breakthroughs in the history of medical science came about entirely by accident.

The discovery of the wheel and the use of fire by the cavemen can also be considered a positive Black Swan Event.

The negative Black Swan Event is just the opposite, where the downside of the event is uncapped while the upside is capped.

PAST OCCURRENCES OF THE BLACK SWAN EVENTS

There have been multiple occurrences in the past, like 1929's Great Depression, 1997's Asian Financial crisis when Asian countries saw their currencies and stock market lose 70% value, 2000's Dot-Com crash, the 9/44 terrorist attack, and 2008;s Great Recession.

The most recent 2020’s Global Lockdown aka Covid Pandemic resulted in a high number of lives lost and triggered the worst economic downfall since 1929’s Great Depression plunging many countries into Economic crisis.

NEXT BLACK SWAN EVENT?

According to a study by the Reserve Bank of India (RBI), a possibility of a capital outflow of $100 Billion from the Indian market has been speculated, which may cause a global risk or a Black Swan Event.

OPPORTUNITIES FROM A BLACK SWAN EVENT

Forst, understand the difference between Positive and Negative Black Swan events. Then identify the businesses with excess exposure to a Positive Black Swan Event and operate in the Positive Black Swan industries. At the same time, prepare for Negative Black Swans, and increase exposure by exploring and following up on anything that slightly resembles an opportunity.

Comments

Post a Comment